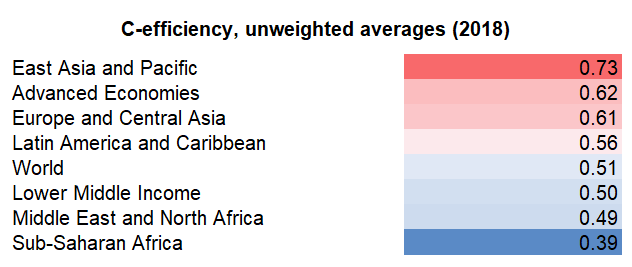

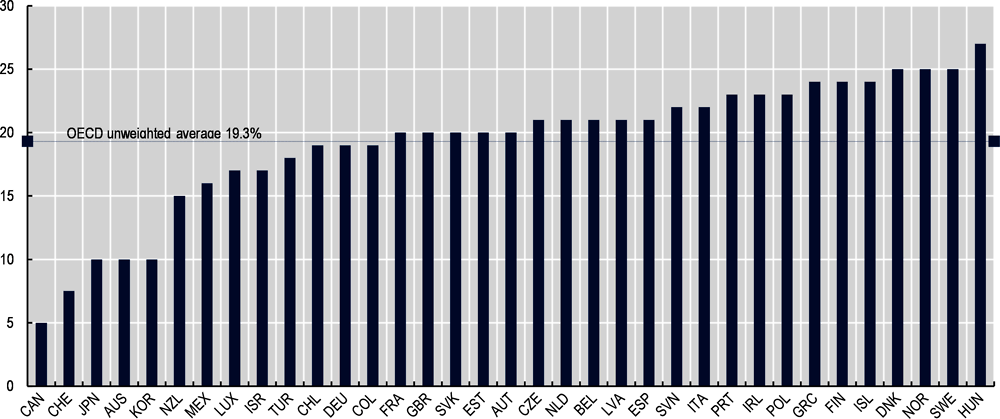

2. Value-added taxes - Main features and implementation issues | Consumption Tax Trends 2020 : VAT/GST and Excise Rates, Trends and Policy Issues | OECD iLibrary

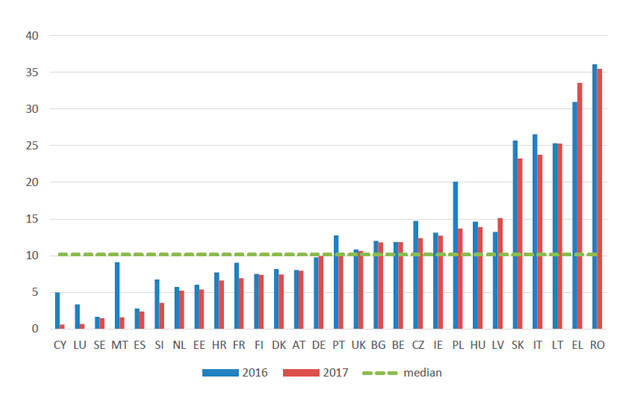

VAT Gap as percent of the VTTL in EU-28 Member States, 2018 and 2017... | Download Scientific Diagram